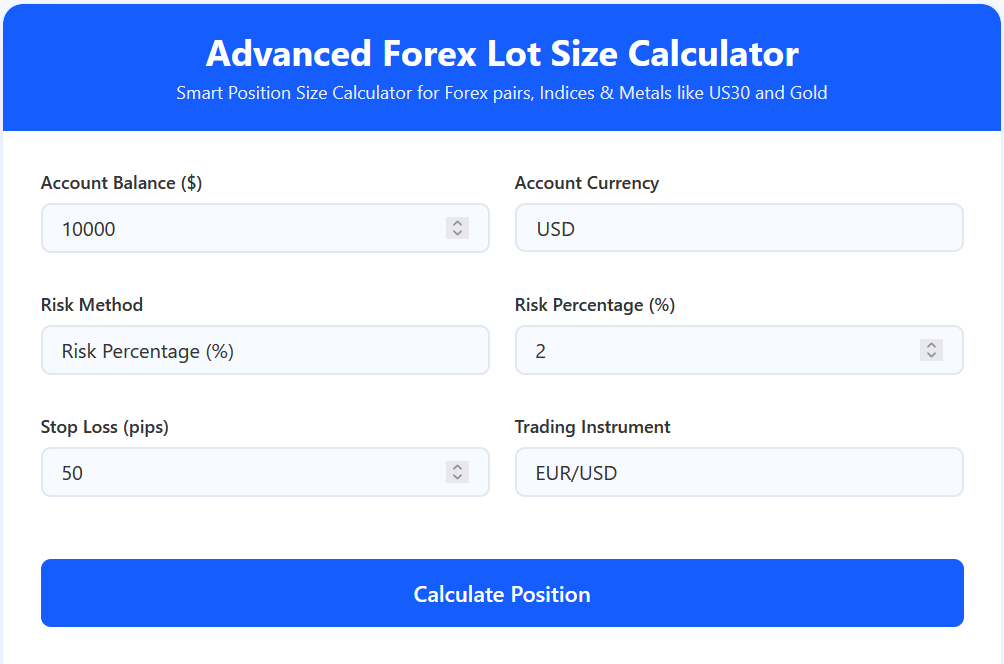

Advanced Forex Lot Size Calculator

Smart Position Size Calculator for Forex pairs, Indices & Metals like US30 and Gold

Calculation Results

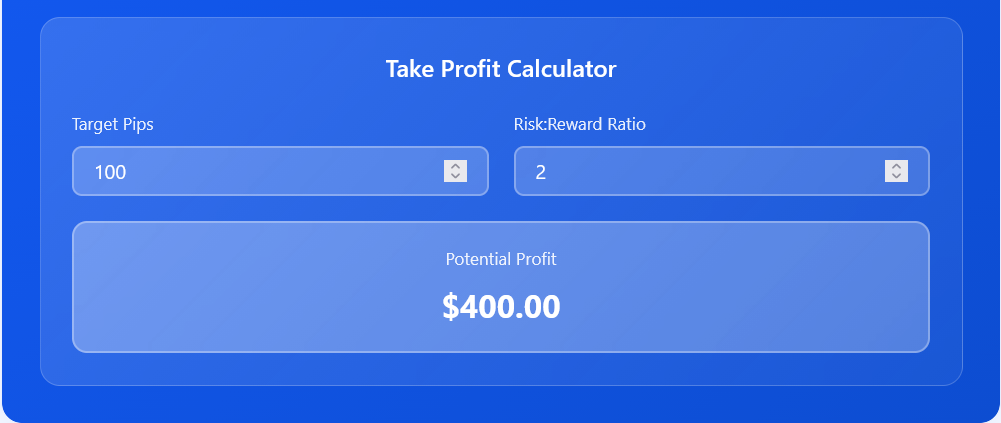

Take Profit Calculator

Ever wondered why your trades keep blowing up even when your strategy looks solid?

You might be ignoring one key thing — lot size.

That’s where our Forex Lot Size Calculator (also known as a Position Size Calculator) comes in.

It helps you find the perfect trade size based on your account balance, risk percentage, and stop loss.

Whether you trade forex pairs, US30, or XAUUSD (Gold), our calculator keeps your risk under control and stops you from over-leveraging.

Let’s break it down.

What Is Lot Size in Forex?

In simple terms, lot size is the amount you trade in the market.

It’s the volume of your position — how many units of a currency pair you buy or sell.

Here’s a quick cheat sheet:

- Standard Lot: 100,000 units

- Mini Lot: 10,000 units

- Micro Lot: 1,000 units

The bigger your lot size, the bigger your potential profit — and your potential loss.

How to Use Our Forex Lot Size Calculator

Don’t worry, it’s easier than it sounds.

Follow these simple steps:

- Enter Your Account Balance

Add how much is in your trading account (e.g., $10,000). - Choose Account Currency

Select USD, EUR, GBP, or whatever currency your account runs on. - Select Risk Method

Decide if you’ll risk a percentage (like 1% or 2%) or a fixed dollar amount. - Enter Risk % or Amount

Example: 2% of $10,000 = $200 risk. - Set Stop Loss (in pips)

Type how far your stop is from entry — say 50 pips. - Choose Trading Instrument

Pick your pair or asset — EUR/USD, XAUUSD, US30, etc. - Click “Calculate”

Our tool instantly shows your:- Standard, mini, and micro lots

- Total position size in units

- Risk amount in dollars

That’s it — you’re ready to place your trade confidently.

Why Every Trader Needs Our Position Size Calculator

Let’s be honest. Guessing your lot size is gambling.

Here’s why our calculator is essential:

1. Accurate Risk Management

You choose your risk; our tool does the math.

No overexposure. No surprises.

2. Fewer Emotional Trades

Once your risk is fixed, there’s no chasing losses or doubling down after wins.

3. Saves Time

Manual formulas are messy. Our calculator gives you instant accuracy.

4. Ideal for Beginners and Pros

Beginners avoid math mistakes. Pros save time. Everyone wins.

Understanding Your Results

Here’s what each value means:

- Standard Lot: 100,000 units (full-size trade)

- Mini Lot: 10,000 units (1/10 of a standard lot)

- Micro Lot: 1,000 units (1/100 of a standard lot)

- Position Size (Units): Your total trade volume

- Risk Amount ($): What you could lose if the trade hits stop loss

You can also use our built-in Take Profit Calculator to test your risk-reward ratio.

Example:

- Risk 50 pips, target 100 pips = 1:2 RR.

- The tool shows your potential profit instantly.

Real Examples: Lot Size in Action

Example 1: Beginner with $1,000 Account

- Risk: 1%

- Stop Loss: 50 pips

- Pair: EUR/USD

Result:

- Lot: 0.02

- Position Size: 2,000 units

- Risk: $10

👉 Safe, steady, smart. Perfect for new traders.

Example 2: Intermediate with $10,000 Account

- Risk: 2%

- Stop Loss: 30 pips

- Pair: GBP/USD

Result:

- Lot: 0.66

- Position Size: 66,000 units

- Risk: $200

👉 Controlled risk, tighter stop, higher efficiency.

Example 3: Conservative vs Aggressive

| Style | Risk % | Stop Loss | Lot Size |

|---|---|---|---|

| Conservative | 1% | 50 pips | 0.20 |

| Aggressive | 5% | 50 pips | 1.00 |

Same setup, different mindset. Our calculator adjusts automatically.

Lot Size for Indices and Commodities

Lot size works differently for instruments like US30 and XAUUSD.

US30 Example

- Balance: $5,000

- Risk: 2%

- Stop Loss: 200 points

Result:

- Lot: 0.10

- Risk: $100

🟢 Tip: Always confirm pip value with your broker.

Gold (XAUUSD) Example

- Balance: $2,000

- Risk: 1.5%

- Stop Loss: 100 pips

Result:

- Lot: 0.15

- Risk: $30

🟢 Tip: Gold is volatile — smaller lot sizes help you stay safe.

Common Mistakes Traders Make Without Our Lot Size Calculator

- Over-Leveraging: Trading too big for your account.

- No Stop Loss: Unlimited risk equals disaster.

- Guessing Lot Sizes: Leads to inconsistent results.

- Ignoring Risk-Reward: No structure = no consistency.

Our calculator keeps your trading logical and disciplined.

Final Thoughts

Consistent trading isn’t about chasing big wins — it’s about managing risk.

That’s exactly what our Forex Lot Size Calculator is designed to do — help you trade smart and stay consistent.

Use it on every trade.

Trade smart. Trade safe.