Risk Reward Calculator Forex

Free forex risk reward calculator — calculate R:R, pips, and breakeven win rate for your trades.

Plan smarter trades with the Forex Risk Reward Calculator with Breakeven Win Rate.

This free tool helps you calculate your risk in pips, potential reward, risk-to-reward ratio (R:R), and breakeven win rate in seconds.

It supports forex pairs, gold (XAUUSD), and popular indices like US30, allowing you to assess trade setups, manage risk, and improve consistency before entering the market.

What Is a Risk Reward Ratio in Forex?

The Risk : Reward (R:R) ratio compares how much a trader risks to how much they could gain.

For example, if you risk 30 pips to potentially earn 90 pips, the ratio is 1:3 — your reward is three times greater than your risk.

In forex trading, understanding R:R helps determine whether a setup is worth taking.

A strong ratio can improve long-term profitability, even with a modest win rate.

Learn more about R:R ratios and trading psychology at Investopedia.

How the Forex Risk Reward Calculator Works

The calculator provides instant results once you input your trade details.

Here’s how it works step-by-step:

1. Enter your trade details:

- Entry Price: The level where you plan to open your trade.

- Stop Loss Price: The price where you’ll exit if the market moves against you.

- Take Profit Price: The price where you plan to close for profit.

- Risk Amount (£ or $): The amount you’re willing to lose.

- Trading Instrument: For example, EUR/USD, XAUUSD (Gold), or US30 index.

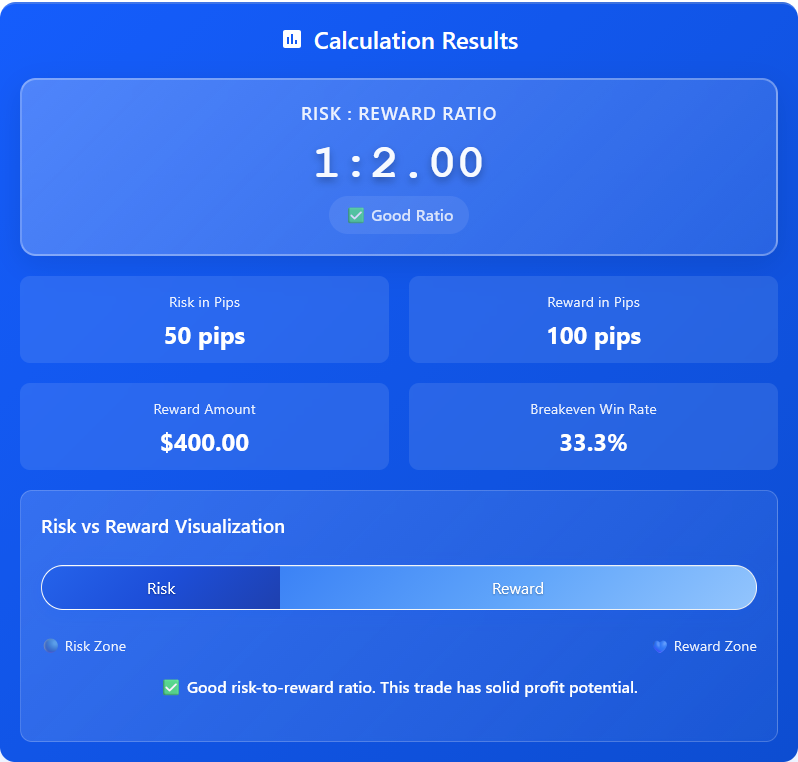

2. Instantly get:

- Risk in pips or points – distance from entry to stop loss.

- Reward in pips or points – distance from entry to take profit.

- Risk : Reward ratio – the potential reward divided by risk (e.g. 1:3).

- Reward amount – potential profit in currency value.

- Breakeven win rate – the percentage of wins needed to avoid losses.

Why Risk Reward Ratio Is Important for Traders

The risk reward ratio is one of the most effective ways to evaluate trade quality.

It helps determine whether a trade is worth the potential downside.

- A higher R:R means fewer winning trades are needed to stay profitable.

- A lower R:R requires a higher win rate to break even.

Examples:

- 1:3 ratio → Only ~25% win rate needed to break even.

- 1:5 ratio → Only ~16.7% win rate needed.

Professional traders focus on setups with a balanced or high R:R rather than chasing frequent wins.

[Link to Risk Management Guide]

Understanding Breakeven Win Rate

The breakeven win rate shows the minimum number of trades you must win to cover losses.

Formula:

Breakeven Win Rate = Risk ÷ (Risk + Reward) × 100

Example:

If your risk is £200 and potential reward is £1,000:

200 ÷ (200 + 1000) × 100 = 16.7%

This means that even if you lose 83% of trades, you still break even — as long as you maintain this ratio.

Examples of Risk Reward Setups

Example 1: EUR/USD 1:2 Setup

- Entry: 1.08500

- Stop Loss: 1.08200 → Risk = 30 pips

- Take Profit: 1.09100 → Reward = 60 pips

- R:R: 1:2 → Requires ~33.3% win rate to break even.

Example 2: Gold (XAUUSD) Example

- Entry: 1950.00

- Stop Loss: 1945.00 → Risk = 5.00 points

- Take Profit: 1965.00 → Reward = 15.00 points

- R:R: 1:3 → Requires ~25% win rate.

Example 3: US30 Index Example

- Entry: 35,000

- Stop Loss: 34,950 → Risk = 50 points

- Take Profit: 35,200 → Reward = 200 points

- R:R: 1:4 → Requires ~20% win rate.

Tips for Using the Risk Reward Calculator Effectively

- Risk a fixed percentage — 1–2% per trade is common among professionals.

- Set stop loss first — determine acceptable loss before setting targets.

- Align targets with market structure — avoid unrealistic price levels.

- Include costs — spreads, slippage, and commissions can slightly reduce real R:R.

For deeper guidance, see IG’s lesson on forex risk management.

Common Mistakes Traders Make with R:R

- Aiming for unrealistic ratios such as 1:10 without price action confirmation.

- Ignoring position sizing, which skews actual risk.

- Over-leveraging, risking too much on one trade.

- Moving stop losses, which increases potential loss instead of managing risk.

Avoiding these mistakes helps keep your strategy consistent and your account protected.

Final Thoughts

The Forex Risk Reward Calculator with Breakeven Win Rate helps traders assess setups, manage exposure, and maintain discipline.

By understanding your potential risk and reward before every trade, you gain clarity and control — the foundation of consistent performance.

Use it to make informed, data-driven trading decisions every time you plan a position.

Whether you trade forex, gold, or indices, use the Forex Risk Reward Calculator as part of your trade planning routine to stay disciplined, objective, and consistent.