Consistency Rule Calculator for Prop Firm & Forex Traders

The ultimate Consistency Rule Calculator for Forex and Prop Firm traders to check their consistency scores.

The ultimate Consistency Rule Calculator for Forex and Prop Firm traders to check their consistency scores.

The Consistency Rule Calculator is a must-have tool for CFD and Futures prop firm traders looking to pass prop firm challenges.

Many well-known prop firms like FundingPips, Maven, Alpha Capital Group, Blueberry Funded, Quant Tekel, FunderPro, E8 Markets, Topstep, Apex Trader Funding, My Funded Futures (mffu), FundingTicks, Tradeify, and FundedNext, etc, have strict consistency rules that every trader needs to follow. Even if you reach your profit target, breaking these rules can lead to disqualification.

This easy-to-use calculator lets you track your daily profits and see if you’re staying within the limits set by prop firms.

Whether you trade forex, CFDs, or futures, the Consistency Score Calculator gives you a clear idea of where you stand, so you can trade with confidence and avoid rule violations.

The Consistency Rule Calculator is designed to help prop firm traders, forex traders, and futures traders quickly check if they are following the consistency rules set by their prop firm.

It’s simple, beginner-friendly, and gives you instant answers — no complicated math required.

Many trusted prop firms like FundingPips, Maven, Blueberry Funded, Topstep, E8 Markets, and Apex Trader Funding use consistency rules to make sure traders show steady performance, not just one lucky trading day. This tool helps you stay on the safe side.

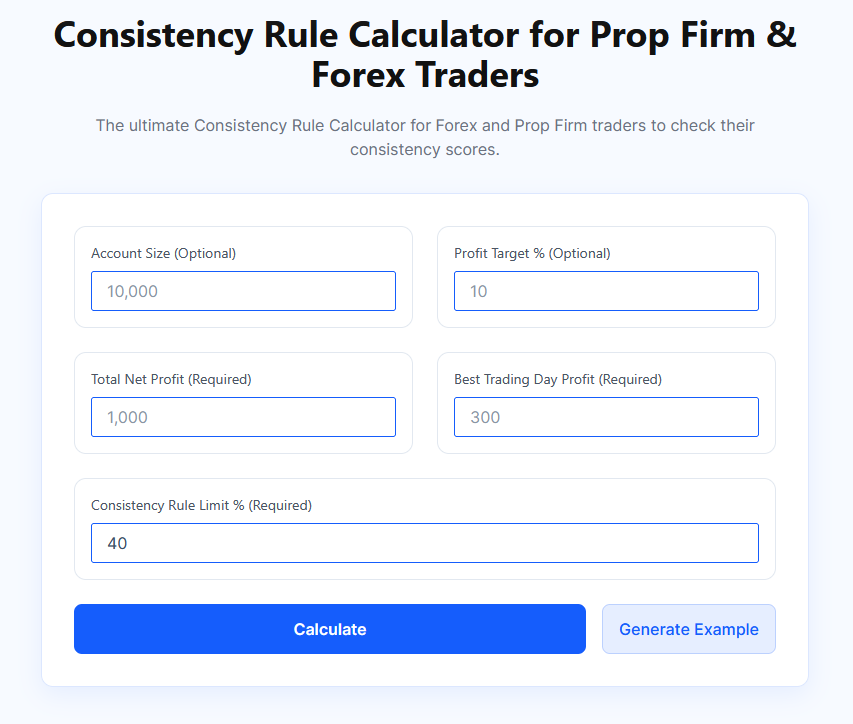

1. Enter Your Account Size (Optional)

If you want, add your account size here. It gives better context but is not required for the consistency calculation.

2. Enter Your Profit Target % (Optional)

If your prop firm has a profit target in percentage terms, you can enter it here for additional insight. This is optional.

3. Add Your Total Net Profit (Required)

This is the total profit you’ve made during your trading challenge or funded account period. This number is needed to calculate your consistency status.

4. Enter Your Best Trading Day Profit (Required)

Type in the amount you made on your most profitable trading day. This is an important part of the consistency rule calculation.

5. Consistency Rule Limit % (Required)

Most prop firms set a specific percentage limit for consistency. For example, E8 Markets, Quant Tekel, or FundingTicks might set this at 40% or 50%. Enter your firm’s limit here.

6. Click the ‘Calculate’ Button

The tool will instantly show you if you meet the consistency requirements based on your data. You’ll see your consistency score, required total profit, and whether you’re within the allowed limit.

Not sure how the calculator works? Just click Generate Example, and the tool will automatically fill in sample numbers for you.

This helps you see a real example of how the results look, making it even easier to understand how the consistency rule applies to your trading.

This is especially useful for beginners who are new to prop firm rules or for anyone who wants to double-check how the tool functions.

The Consistency Rule Calculator removes the guesswork. Instead of stressing over manual calculations, you can quickly find out:

✅ If your trading results meet your prop firm’s consistency rule

✅ How much total profit you need to stay compliant

✅ If your best trading day exceeded the allowed limit

✅ A clear, simple message telling you where you stand

Whether you trade forex, CFDs, or futures, this tool helps you stay focused on what matters — consistent, smart trading.

The Consistency Rule is a common requirement used by many prop firms to make sure traders show stable, steady performance over time.

It prevents traders from passing a challenge or earning profits just by getting lucky with one or two big trades.

Simply put, this rule limits how big your best trading day can be compared to your total profits.

If your best day is too large compared to your overall profits, you might break the rule — even if you’ve reached your profit target.

Let’s say you are trading with a $100,000 prop firm account, which is very common in the forex and futures world.

Your prop firm has set these rules:

✅ Profit Target: 10% → You need to make $10,000 profit to pass the challenge or withdraw profits

✅ Consistency Rule Limit: 40% → Your best trading day cannot be more than 40% of your total profits

Let’s check if you meet the consistency rule:

40% of total profits = $8,000 x 40% = $3,200

But your best trading day was $4,000, which is more than $3,200, meaning you’ve broken the consistency rule.

Different prop firms handle this differently:

✔ During a trading challenge, your profit target may increase. So instead of needing $10,000 profit to pass, the firm may now require more, depending on your best day.

✔ In a funded account, some firms may stop you from withdrawing profits until your total profits grow enough to meet the consistency rule.

This is why understanding this rule early — and tracking your numbers with the Consistency Rule Calculator — is so important.

From a firm’s perspective, the consistency rule protects their capital. They want traders who:

✅ Trade steadily, not aggressively gambling

✅ Show controlled risk-taking

✅ Avoid overleveraging

✅ Have a realistic, long-term approach

Prop firms like Maven, Quant Tekel, FundingTicks, and Apex Trader Funding want traders who treat the firm’s capital with care, not like a lottery ticket.

Many traders break this rule simply because they don’t track their stats. By using the Consistency Rule Calculator, you can:

✔ Instantly check if your best day is within the allowed limit

✔ Know how much total profit you need to stay compliant

✔ Plan your trades to avoid breaking the rule by accident

The consistency rule might seem strict at first, but it actually serves an important purpose for both the trader and the prop firm.

It’s not there to make things harder — it exists to encourage stable, disciplined trading.

Prop firms provide traders with access to large accounts, sometimes $50,000, $100,000, or even more.

But with that opportunity comes responsibility. The firm needs to be sure that the trader is not just relying on one lucky trade to pass the challenge or withdraw profits.

✅ Protecting Capital

Prop firms are essentially trusting traders with their money. If traders make huge, risky trades and get lucky, it might look good for a short time, but it increases the chance of blowing the account later.

The consistency rule filters out those risky, luck-based traders.

✅ Encouraging Good Trading Habits

The rule motivates traders to focus on small, steady gains instead of chasing big, risky profits.

Over time, this builds strong trading discipline — a skill that helps traders succeed long after the challenge is over.

✅ Building a Win-Win Relationship

Prop firms want traders to make money, but in a controlled, reliable way.

When traders stay consistent, both the trader and the firm can benefit — the trader gets funded and earns payouts, and the firm protects its capital.

It’s important to know that not all prop firms apply the consistency rule in the same way.

Some may only enforce it during the trading challenge, while others also apply it to funded accounts. Some firms might not have a consistency rule at all.

That’s why it’s always smart to carefully read the rules of any firm you apply to — so there are no surprises later.

The consistency rule doesn’t just exist to sound complicated — it can have a real impact on your trading progress, especially when you’re working hard to pass a prop firm challenge or trying to withdraw profits from a funded account.

Depending on the rules set by your prop firm, the consistency rule can apply during different stages of your trading journey. Understanding how it affects you is key to avoiding surprises later.

For most traders, the first hurdle is passing the firm’s trading challenge. This is where the consistency rule often comes into play.

Here’s how it works:

✔ You need to reach a specific profit target to pass the challenge

✔ At the same time, your best trading day cannot exceed a set percentage of your total profits

✔ If your best day is too large compared to your overall performance, you may break the rule

What happens if you break it?

In many cases, breaking the consistency rule doesn’t mean you fail the challenge completely.

But your profit target might increase, making it harder to pass. You’ll need to keep trading until you meet the new target and satisfy the consistency requirement.

After passing the challenge, traders often assume they’re in the clear — but that’s not always true.

Some prop firms apply the consistency rule even after you get funded.

In this case, the rule usually affects your ability to withdraw profits.

Here’s how:

✔ If your best trading day is too large compared to your total profits, you might not be able to request a payout

✔ You’ll need to continue trading until your total profits grow enough to meet the consistency rule

✔ Only then can you withdraw your profits

It’s important to read your firm’s rules carefully, as some firms only apply the rule during the challenge, while others keep it in place for funded traders too.

Many traders focus so much on reaching their profit target that they forget to track their best day’s profit.

Without realizing it, they break the consistency rule and face delays in getting funded or withdrawing profits.

The Consistency Rule Calculator helps avoid this by giving you a clear picture of where you stand — so you stay prepared at every stage.

Not all prop firms operate the same way, especially when it comes to the consistency rule.

Some firms apply it strictly during the challenge stage, others keep it in place even after you get funded, and a few firms may not use this rule at all.

That’s why it’s important to know what to expect before you sign up with a prop firm. Understanding their rules can save you from disappointment later.

Many firms that offer funded accounts for forex, commodities, or CFD traders apply some form of consistency rule. For example, some traders have reported that firms like FundingPips, Maven, Blueberry Funded, Alpha Capital Group, Quant Tekel, and E8 Markets may use a consistency rule during their challenges.

This helps them select traders who show steady, controlled performance rather than relying on one-off big trades.

The consistency rule is also common in the futures trading world.

Firms that provide funded futures accounts — like Topstep, Apex Trader Funding, MyFundedFutures, Tradeify, FundingTicks, and FundedNext — often have similar rules in place to encourage stable trading.

In some cases, these firms apply the rule only during the simulated challenge stage.

In other cases, the rule continues even after you receive a funded account, especially when it comes to requesting profit payouts.

No, not every prop firm uses a consistency rule. Some firms are more flexible, while others are strict about promoting disciplined, consistent trading habits.

That’s why reading the firm’s rulebook is so important. Even experienced traders can be caught off guard if they skip the fine print.

Before signing up for a challenge, always:

✔ Read the full terms and conditions

✔ Look for any mention of a consistency rule

✔ Ask questions if anything is unclear

✔ Use our tool the Consistency Rule Calculator to track your progress once you start trading

This simple preparation can save you a lot of stress down the line.

Consistency in trading doesn’t happen by accident — it comes from building good habits and sticking to a smart plan.

If you want to succeed with a prop firm, especially when rules like the consistency rule are in place, you need to approach trading with patience and discipline.

Here are some simple but powerful tips to help you stay consistent and avoid breaking the rules.

Before you enter any trade, know exactly why you’re taking it. A solid trading plan should include:

✔ Your entry and exit points

✔ How much you’re risking per trade

✔ Your target profit levels

When you follow a clear plan, your results tend to be more steady — exactly what prop firms want to see.

Risk management is key to consistency. This means:

✔ Never risking more than a small percentage of your account per trade

✔ Using stop-loss orders to protect your capital

✔ Avoiding oversized trades that can lead to big wins — or big losses

Many traders break the consistency rule simply because they take one huge trade.

It may work out in the short term, but it hurts their chances of passing the challenge or withdrawing profits later.

You don’t need massive trading days to succeed. In fact, small, steady profits are exactly what prop firms want to see.

Aim to:

✔ Build your account slowly over time

✔ Avoid chasing huge, risky trades

✔ Be patient and let your results add up day by day

One of the easiest ways to stay consistent is to track your trades. Keep a simple journal where you note:

✔ Your daily profit or loss

✔ Your best trading day so far

✔ Your total net profits

Better yet, use the Consistency Rule Calculator regularly to make sure your results are staying within the allowed limits.

Trading can be emotional, especially after a big win or loss. But emotional trading often leads to inconsistency.

Stay calm, stick to your plan, and remember — consistency is more important than chasing fast profits.

Consistency isn’t about being perfect — it’s about sticking to your process, managing risk, and building profits steadily.

With the right habits and tools, passing a prop firm challenge or maintaining a funded account becomes much easier.

At the end of the day, trading is not about complicated strategies or chasing massive profits.

It’s about keeping things simple and consistent. That’s exactly what prop firms look for — traders who can show steady results, control their risk, and avoid gambling with their accounts.

Our Consistency Rule Calculator is here to help with that. It gives traders a clear, no-nonsense way to track their performance and stay within the rules.

Whether you’re new to prop firm challenges or already managing a funded account, staying consistent is always the smart way forward.

The Consistency Rule Calculator is a free online tool that helps CFD and Futures prop firm traders check if they are meeting the consistency rule set by their prop firm. It saves time and avoids manual calculations.

It’s simple! Just enter your biggest profitable trading day and the required consistency percentage of your prop firm. The calculator instantly shows you the minimum total profit you need to stay within the consistency rule.

This tool is designed for CFD and Futures prop firm traders working with prop firms that have consistency rules in place. It’s useful for both traders attempting a challenge and those already funded.

No, each prop firm can set its own consistency rule or choose not to have one. The percentage may vary, so always check your prop firm’s specific rules. This calculator helps you track your numbers based on their requirement.

Yes, the Consistency Rule Calculator is 100% free to use. There are no hidden fees or paid versions. It’s built to help the trading community stay consistent and avoid payout delays.

Yes, the Consistency Rule Calculator works for both forex and futures prop firm traders, as long as your firm has a consistency rule in place.